Q1 2024 Proptech Jobs Index: Trends & Transformations

The proptech job market significantly impacts the broader real estate landscape, investment decisions, and broader economic trends. The CRETI Proptech Jobs Index provides essential insights into hiring trends within proptech. The CRETI Proptech Jobs Index is critical as it reflects shifts in employment that correlate with the overall health and wellness of the proptech ecosystem and financial activity.

Hybrid/Remote Roles Dominate: Reflecting a post-pandemic shift towards flexible working arrangements, a significant portion of proptech roles now favor hybrid or remote settings, enhancing job satisfaction and potentially broadening the talent pool by removing geographical barriers.

Senior Leadership in High Demand: There is a pronounced focus on recruiting senior and executive-level professionals, signaling a need for experienced leaders who can steer companies through phases of growth and navigate the complexities of the proptech industry.

Strategic Investment in Entry-Level and Internships: Despite the emphasis on senior roles, the consistent availability of entry-level positions and internships illustrates a strategic commitment to cultivating a robust pipeline of talent, ensuring long-term sustainability and innovation within the sector.

Q1 2024 Proptech Employment Dynamics and Regional Trends

As the first quarter of 2024 unfolds, the proptech job market offers a vivid tableau of industry evolution and shifting paradigms across global regions. From the rise of remote work to the increasing demand for senior leadership, the proptech sector is not only responding to ongoing economic flux but is also actively shaping new workforce standards. This comprehensive analysis delves into the job creation and hiring trends within the proptech industry, providing insights into its current state and potential future trajectory.

January 2024: A Promising Start with Emphasis on Flexibility and Leadership

January set a strong pace for the proptech job market, with a notable shift towards hybrid and remote roles, particularly in the United States where such positions constituted 62% of new job openings. This trend highlights the sector's adaptation to post-pandemic work preferences, merging flexibility with productivity. Additionally, the demand for experienced professionals has surged, with senior roles accounting for 56% of the new openings in the U.S. alone, underscoring the industry’s need for seasoned leadership to navigate the complex landscape of real estate technology.

The global distribution of jobs also reflected a balanced approach between preserving operational efficiency and fostering growth, with entry-level roles and internships gaining traction, especially in Latin America where they represented half of the new openings. This suggests an encouraging environment for emerging talent and a strategic focus on building a resilient talent pipeline capable of sustaining long-term growth.

February 2024: Consolidation and Strategic Realignment

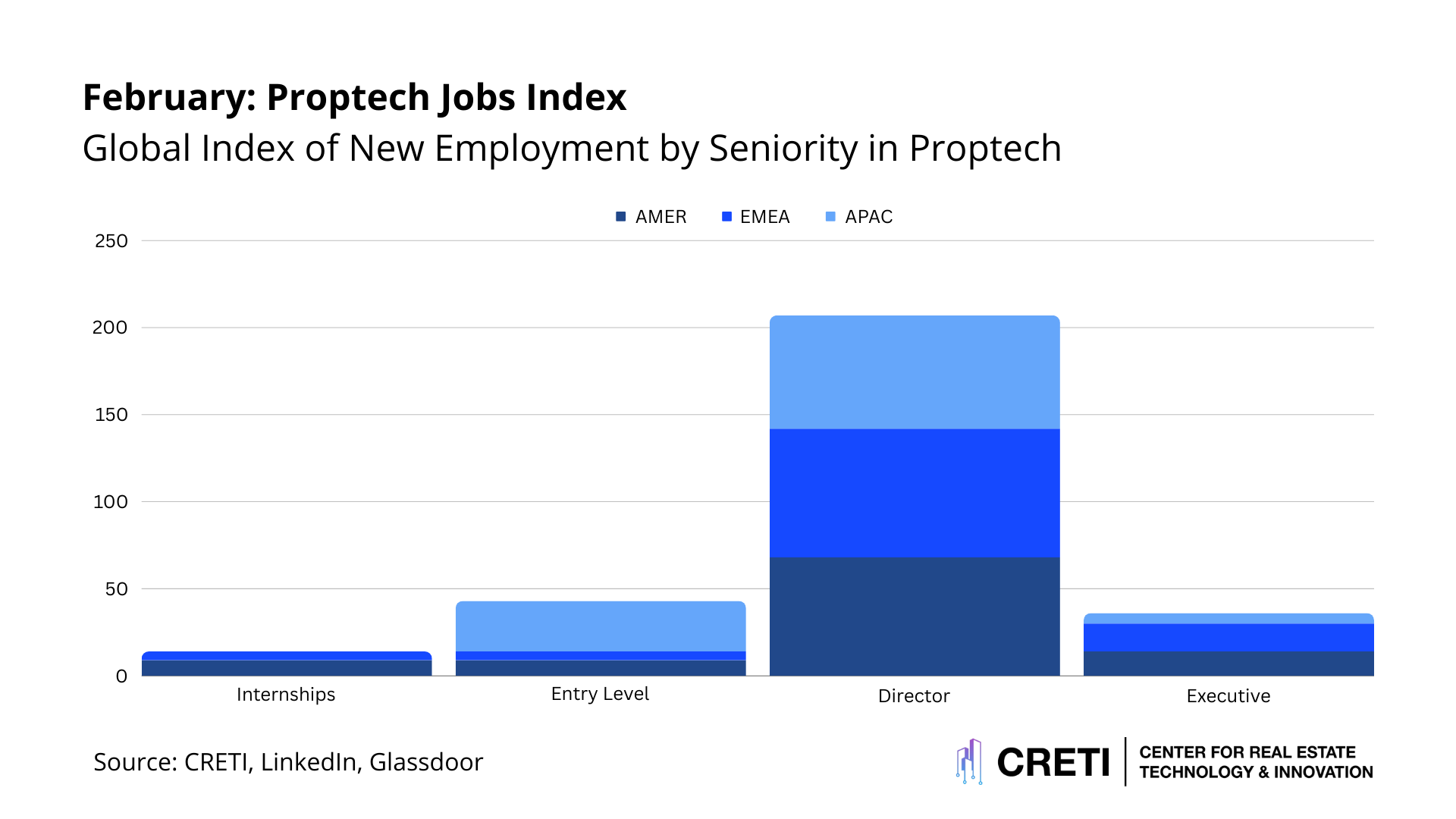

The trends observed in February indicated a consolidation in the proptech sector, with a significant decline in new job creations compared to the previous year, particularly in the AMER and EMEA regions. This reduction could be attributed to a variety of factors including market adjustments and economic uncertainties. Despite the overall decrease in job openings, there was a clear strategic emphasis on senior leadership across all regions, with a staggering 80% of the new roles in EMEA dedicated to director and executive levels.

The APAC region presented a contrast, not only maintaining but also increasing its job market footprint with a significant allocation of roles to entry-level positions. This reflects a region-specific strategy aimed at cultivating a new generation of proptech professionals, potentially signaling a burgeoning phase of growth and development within APAC's proptech sector.

March 2024: Market Recalibration and Regional Divergence

March saw a further contraction in the proptech jobs market, with only 84 new positions reported globally, indicating a cautious approach to hiring across the industry. However, the distribution of job roles highlighted an interesting divergence; while AMER increased its focus on internships, suggesting an investment in future talent, EMEA continued to prioritize senior roles, emphasizing the need for seasoned leadership.

APAC’s targeted hiring strategy remained consistent with its previous month's approach, focusing predominantly on director roles. This continued emphasis on experienced professionals could be indicative of ongoing strategic initiatives that require established expertise to lead.

Forward Outlook

Comparing the first quarter of 2024 with the same period in 2023, there is a noticeable shift towards strategic and cautious hiring practices. The emphasis on senior leadership roles across the board suggests that the proptech sector is entering a phase of maturity where strategic direction and experienced oversight become paramount. Meanwhile, the investment in internships and entry-level positions, particularly in regions like AMER and APAC, points to an optimistic outlook on building a sustainable workforce capable of supporting future growth.

As proptech continues to evolve, adapting to both technological advancements and market dynamics, the sector's employment trends offer valuable insights for companies, investors, and professionals. The strategic focus on senior roles coupled with the nurturing of new talent could well define the trajectory of the proptech industry in the coming years, potentially leading to a more robust, innovative, and resilient marketplace.