February Proptech Jobs Index

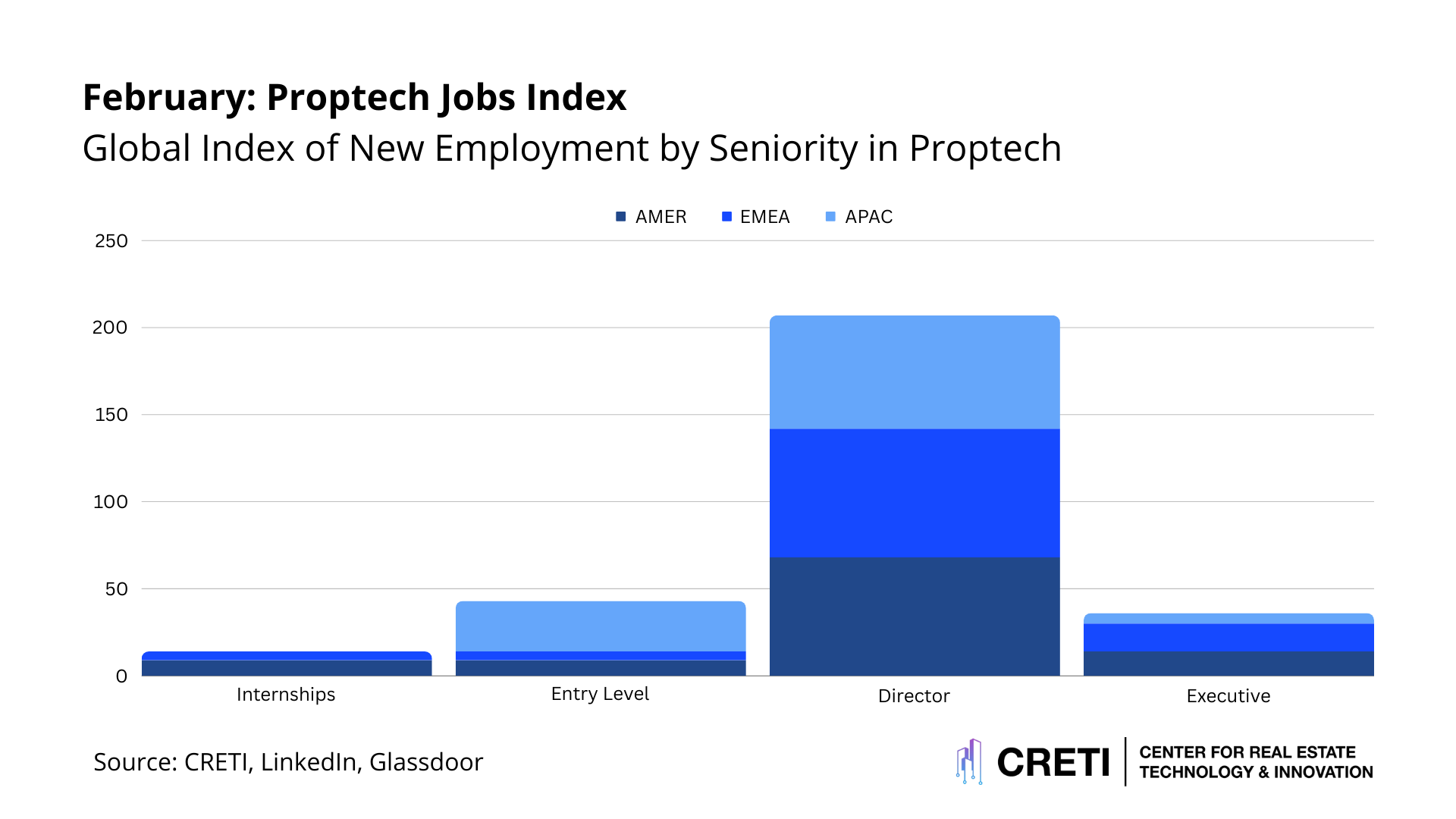

Senior-level hiring continues to surge as new employment opportunities continue to decline in February 2024.

Trend 1: Shift Towards Senior Leadership Hiring:

A large portion of new hires across all regions are for senior roles, with Director and Executive positions constituting over 80% in the EMEA, approximately 82% in AMER, and 71% in APAC. This highlights a strategic emphasis on leadership and experience over entry-level or internship positions.

Trend 2: Regional Variability in Entry-Level Hiring:

The APAC region shows a distinct approach by allocating a significantly higher percentage of its new hires to Entry-Level positions (29%), compared to a much lower emphasis in AMER and EMEA (both at 9% and 5% respectively). This underscores a regional disparity in investment in emerging talent.

Trend 3: Overall Decrease in New Job Creation with Regional Exceptions:

While the AMER and EMEA regions experienced a year-over-year decrease in the total number of new jobs created, the APAC region saw an increase, suggesting a complex interplay of regional market dynamics and perhaps a more optimistic outlook or growth phase in the APAC proptech sector.

The real estate technology sector (“proptech”) has witnessed varying trends in employment across the AMER (North and South America), EMEA (Europe, the Middle East, and Africa), and APAC (Asia-Pacific) regions in February 2024. By dissecting job creation data and employment level distributions within these regions, we can glean insights into the current state and future direction of the proptech employment market.

In the AMER region, a total of 194 new jobs were reported in February 2024, marking a significant decrease from the 429 jobs reported in February 2023. This decline reflects a broader trend of cautious hiring within the proptech sector amidst economic uncertainties. The distribution of roles in AMER shows a heavy leaning towards senior positions, with Director roles comprising 68% of new hires, followed by Executive positions at 14%, and both Internships and Entry-Level positions at 9% each. This suggests a focus on strengthening strategic leadership rather than expanding the workforce at lower levels.

The EMEA region, however, remains the hotbed for proptech employment, with 946 new jobs reported in February 2024, despite a slight decrease from 1078 jobs in February 2023. The job role distribution here is even more skewed towards higher-level positions than in AMER, with Director roles accounting for 74% of new hires and Executive positions at 16%. Internships and Entry-Level jobs are both at 5%, indicating an even greater emphasis on seasoned professionals to navigate the complex proptech landscape in this region.

Conversely, the APAC region presents a different picture, with a notable increase in job creation from 272 in February 2023 to 366 in February 2024. This region shows a more balanced approach to hiring, with a significant 29% of positions aimed at Entry-Level candidates, although Director roles still dominate at 65%. The proportion of Executive roles is the lowest among the regions at 6%, and notably, there were no Internship positions reported in February 2024.

Three key trends emerge from this analysis: a general reduction in new job creation within the proptech sector year-over-year, with the exception of APAC which saw growth; a pronounced concentration on hiring for senior roles across all regions, highlighting a strategic push towards leadership and experience in navigating market challenges; and a stark regional divergence in hiring practices, especially notable in the APAC's unique focus on Entry-Level roles, suggesting a region-specific strategy to build a pipeline of talent for future growth.

The proptech job market in February 2024 reveals a clear strategic pivot towards bolstering senior leadership across the globe, with a notable regional divergence in the approach to nurturing entry-level talent, particularly in APAC. These trends underline the evolving dynamics within the proptech employment landscape, hinting at a cautious but strategic approach to hiring amidst a complex global economic backdrop.